Sharing: Reflecting on an original form of philanthropy, with or without a tax deduction

The income tax charitable deduction was first introduced by the War Revenue Act of 1917. At the same time, federal income tax rates were increased to help fund World War I. Lawmakers were worried that the increases in taxes would reduce support for charities, thereby increasing charities’ reliance on government, which in turn would require another tax increase.

But philanthropy is a lot older than 1917! “Philanthropia” is a word from the ancient Greeks that means “love of humanity.” For centuries, human beings have depended on kindness to each other, and helping people by sharing some of what they have with people who need it.

Fast forward to today, when many Americans consider philanthropy to be part of a social impact lifestyle. How does sharing what you have with others fit into the picture? I think about that a lot, especially as I reflect on a scene that repeats itself over and over at my house. The item in question has changed over the years, but the "sharing" play-by-play is still the same.

It goes something like this: Child #1 yanks a Barbie sticker book right out of Child #2’s hands. Catching Child #1 in the act, I jump into the fray. “What do we know about sharing?” I typically ask. “I don’t like it!” retorts Child #1. This is followed by my futile attempt to convince my daughter that she shouldn’t even want the book in the first place because all of the stickers are gone. But that would be too logical!

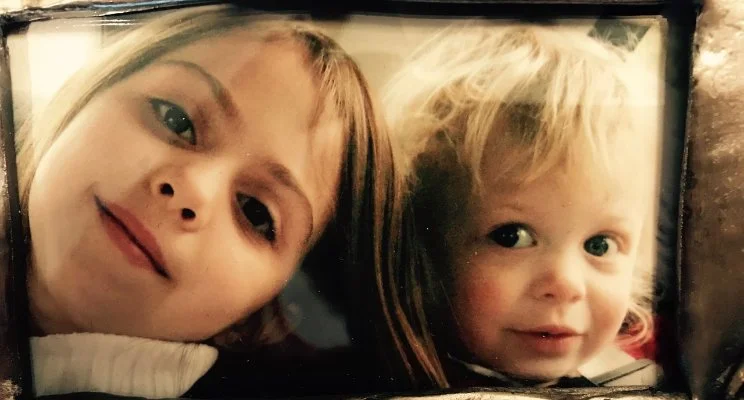

Sharing did not come naturally to my children when they were toddlers! As my girls get older, though, they are learning a lot more about the value of sharing. Not only does it keep them out of trouble, but they are learning that it also feels good to let others in on the fun of whatever you’re doing.

Sharing as a form of "doing good" isn’t just for kids. Think about how many times each year or month you help out a friend, neighbor, or family member by giving a little bit of what you have. You might cook dinner for a neighbor who is under the weather, slip a few dollar bills into the envelope going around the office for a colleague who needs help paying medical bills, or stop by a retirement home with your kids during the holidays to drop off sugar cookies.

"Sharing" is a great way to describe philanthropic acts that don’t quite fit the Internal Revenue Code’s definition of “doing good.”

Here’s a good example. A few years ago, a bank manager called me for legal advice. He was interested in collecting money to set aside for a ten-year-old’s education. The child’s parents, customers of the bank, had recently died in a car accident. The man wanted to do something good to help the little boy who was tragically left without parents.

“I’d love to set up a bank account and ask my friends at the office to contribute money to support the child’s future education,” he explained. “We’ve also had calls from bank customers offering to help. Is this something I can do?”

“Of course you can do that,” I said. “What a wonderful idea!”

“Great,” said the bank manager. “And we all will get a tax deduction for our contributions, won’t we?”

Ooh. That’s not how it works. “Unfortunately not,” I said. I explained that the IRS does not allow charitable deductions for gifts that are intended to benefit specific individuals or families directly. “The issue is potential self-dealing and private benefit,’” I said. “There’s no objective criteria or application process for selecting this child as the beneficiary,” I explained. “For a charitable tax deduction to apply, you would need to set up the scholarship fund under a 501(c)(3) organization and then create an open process where this child and other children could submit applications for the funds. You would need an independent group of people to evaluate the applications, and there could be no guarantee that any particular child would receive the money.”

“That doesn’t make any sense,” the bank manager said. “I’m not getting any benefit by doing this, and neither are the people who would be contributing money. But still no tax deduction. Are you sure that’s right?”

I was sure. This is a question I hear a lot, actually, because so many people want to support friends and family in need. Many people assume there will be a tax deduction available for their contributions.

“It really is a nice thing to do,” I said reassuringly. “Just because the IRS doesn’t think it qualifies as a charitable contribution doesn’t mean it isn’t good. You are making a huge difference in the life of this child!”

The bottom line is this: You can’t claim a tax deduction for money you give directly to your friends, family, or a person or family in need. But sharing what you have with people who need it still counts as “doing good”! Make sure to give yourself a high five every time you help people in ways that don’t fall under giving to a 501(c)(3) organization or otherwise qualify for a charitable tax deduction under the Internal Revenue Code. You're good!